Introduction — Why Most ICPOs Are Rejected Instantly

Every day, sellers, refineries, tank farms, and allocation holders receive hundreds of ICPOs for:

EN590

Jet A1

Diesel

LPG

Crude

Fuel Oil

LCO

ULSD

Yet 70% of ICPOs are rejected instantly, without review, without negotiation, and without a single response.

Why?

Because most ICPOs:

❌ Don’t match refinery protocols

❌ Don’t include proper KYC

❌ Are written by brokers

❌ Contain contradictions

❌ Use Gmail/Hotmail emails

❌ Ask for impossible procedures

❌ Do not include financial readiness

❌ Are incomplete, unrealistic, or non-compliant

A poorly written ICPO destroys your reputation instantly.

This article explains:

What a REAL refinery-acceptable ICPO looks like

Why sellers reject most ICPOs

How to structure an institutional ICPO

How to pass compliance easily

How to avoid every common mistake

How NNRV ensures your ICPO gets accepted on first submission

SECTION 1 — Understanding the Context: Why ICPO Quality Determines Deal Success

1.1 ICPO = Binding Intent, Not a “Letter of Interest”

A proper ICPO (Irrevocable Corporate Purchase Order) is:

Legally binding

Corporate commitment

A trigger for compliance

A precursor to SPA

A pre-POP validation instrument

Refineries treat ICPO as serious corporate intention.

Therefore, anything amateurish = rejection.

1.2 Sellers Receive More Fake ICPOs Than Real Ones

Refineries report that MOST ICPOs submitted globally are fake because:

Brokers impersonate buyers

Buyers don’t understand procedures

Documents do not match the company

No business profile exists

ICPO is copy-paste from the internet

No real financial capability

Thus sellers reject 70% of them to protect:

Their tank allocations

Their refinery relationships

Their internal compliance

Their reputation

1.3 ICPO Submission Is a Compliance Event

When a seller receives an ICPO, they must:

Open a file

Conduct KYC

Perform business verification

Run sanctions checks

Validate UBO

Review bank acceptability

Check company history

A bad ICPO wastes their compliance resources → automatic rejection.

SECTION 2 — The A–Z Breakdown: Why Sellers Reject ICPOs (Top 12 Reasons)

Here are the 12 institutional reasons why sellers reject ICPOs:

1. ICPO Doesn’t Match the Buyer’s KYC

If company registration says:

“Agriculture company”

But ICPO says:

“Requesting EN590 1,000,000 MT/month”

→ Rejection.

2. ICPO Sent from Gmail/Yahoo

Refineries never accept:

gmail.com

yahoo.com

outlook.com

Only corporate domain emails are valid.

3. No Financial Readiness (POF)

Sellers reject ICPOs without:

RWA letter

BCL letter

MT799

SBLC

LC readiness

No POF = no deal.

4. ICPO Contains Unrealistic Quantities

Examples that cause rejection:

“500,000 MT trial”

“5M MT per month for 12 months”

“CIF worldwide without LC”

Unrealistic demand triggers automatic blacklist.

5. Buyer Asks for POP Before POF

A fatal red flag.

Real sellers NEVER release POP without:

SPA

POF

Compliance approval

6. ICPO Contradicts Seller Procedure

Buyers send ICPOs demanding:

POP before SPA

DIP test before POP

Editable SPA

Tanks before KYC

Instant rejection.

7. No Company Profile Included

Sellers need a professional 2–6 page profile.

Without it → rejection.

8. ICPO Contains Broken English / Typographic Errors

It signals non-institutional behavior.

9. ICPO Has No Specifications

Serious buyers must specify:

EN590 Euro Grade

Sulfur level

Density

Incoterm

Port

Quantity

Contract length

Payment method

Without specs → rejection.

10. ICPO Sent by a Broker, Not the Buyer

Sellers confirm:

Email domain

LinkedIn presence

Company registration

Board signatures

Any inconsistency → rejection.

11. No Understanding of SWIFT Flow

If buyer cannot define:

MT103

MT799

MT760

DTA

POP

They fail compliance instantly.

12. ICPO Is Copy-Paste

Fake templates are automatically rejected.

SECTION 3 — NNRV Expert Analysis: What a REAL ICPO Must Contain

A real ICPO includes ALL the following:

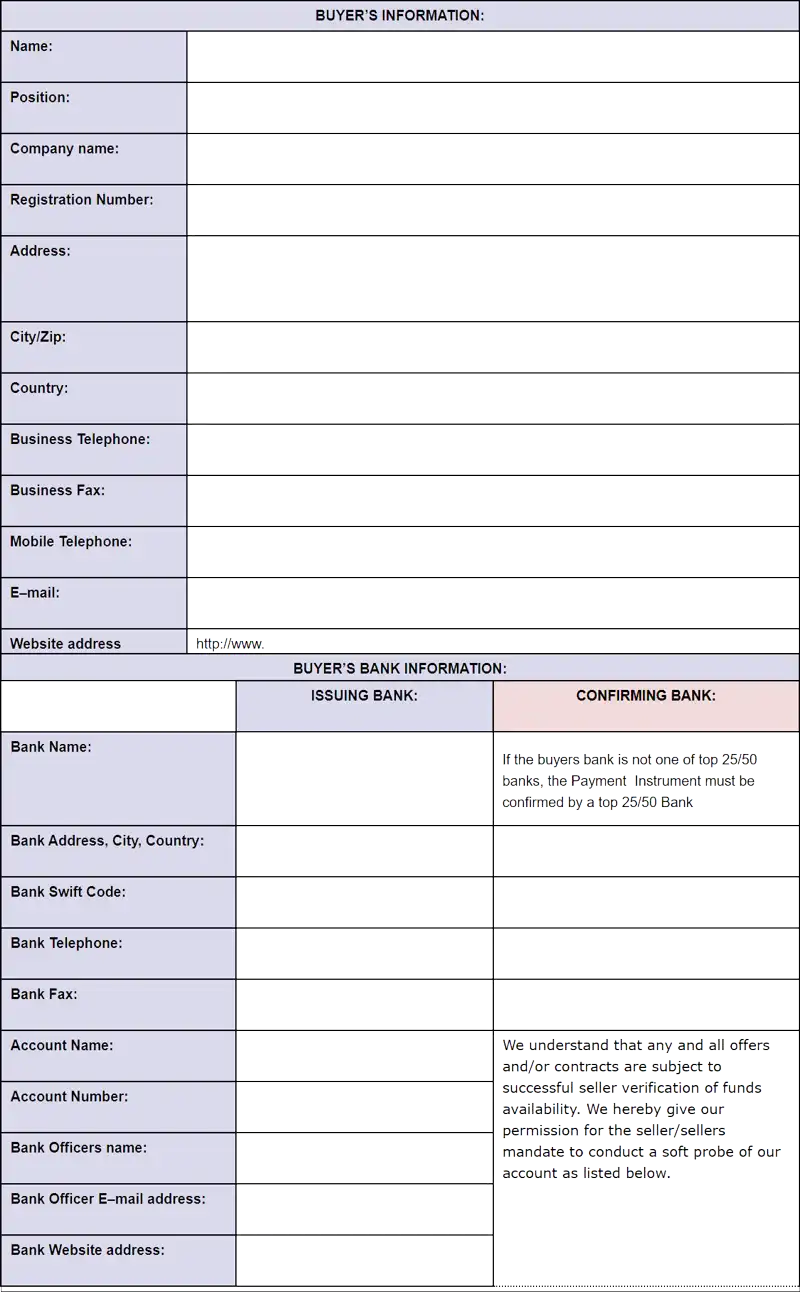

3.1 Complete Buyer KYC Package

✔ Certificate of Incorporation

✔ Company registry record

✔ UBO declaration

✔ Passport of director(s)

✔ Proof of Address

✔ Company profile (mandatory)

✔ Website + domain email

3.2 Full Technical Specifications

Product → EN590 10 ppm ULSD (Euro 5)

Port → Rotterdam / Fujairah / Jurong

Procedure → Seller’s procedure (mandatory)

Delivery Mode → TTT / TTV / FOB / CIF

Inspection → SGS / Saybolt

Quantity → realistic

3.3 Clear Financial Intent

POF type:

MT799

RWA letter

BCL

LC MT700

SBLC MT760

Any valid POF = accepted.

3.4 SPA Readiness

Sellers need confirmation buyer is ready to:

Review SPA

Sign SPA

Engage bank compliance

Provide MT799 within timeline

3.5 Legally Binding Commitment

ICPO must include:

Quantity

Price expectation (optional)

Procedure acceptance

Signed & sealed document

Board resolution (if needed)

SECTION 4 — Step-by-Step: How to Write a Real ICPO That Sellers Accept

Step 1 — Collect Full KYC

Company registration + UBO.

Step 2 — Draft a Professional Company Profile

2–6 pages, institutional.

Step 3 — Request Seller’s Procedure First

You must align your ICPO with their protocol.

Step 4 — Confirm POF Method

MT799 / SBLC / LC.

Step 5 — Draft ICPO With ALL Mandatory Sections

Clear, clean, compliant.

Step 6 — Use Domain Email Only

Never use Gmail.

Step 7 — Submit ICPO + KYC Together

Compliance begins immediately.

Step 8 — Be Ready for Bank-to-Bank

If seller asks for MT799 or RWA, your bank must respond.

SECTION 5 — Buyer & Seller Questions (20 Professional Q&A)

10 Buyer Questions

Why must ICPO match seller procedure?

Can I request SPA before ICPO?

Is POF mandatory?

Can I hide final buyer?

What if I don’t have a company website?

Can I use LOI instead of ICPO? (No)

Which port should I select?

Can I negotiate seller’s procedures?

How much quantity is realistic?

Can NNRV write my ICPO? (Yes)

10 Seller Questions

How do I identify fake ICPOs?

Should I accept ICPO without KYC? (Never)

What is the ideal ICPO format?

Should I require POF?

How do I avoid broker chains?

When is SPA sent?

When do I release POP?

Should I accept Gmail buyers?

Can NNRV screen buyers? (Yes)

What is the minimum ICPO compliance level?

SECTION 6 — Why This ICPO Format Is Globally Recognized

It complies with:

ICC Incoterms 2020

Basel III & FATF AML frameworks

International SWIFT protocols

Refinery KYC standards

OFAC / EU sanctions rules

ISPS port security regulations

It is the same format used by:

Vitol

Trafigura

Mercuria

Glencore

Gunvor

Shell Trading

TotalEnergies

SECTION 7 — Professional CTA

📌 Need a Real ICPO That Sellers Accept?

NNRV Trade Partners prepares:

Institutional-level ICPOs

Full buyer compliance packages

KYC structuring

POF arrangement (RWA/BCL/MT799)

SPA negotiation support

Seller verification

Complete refinery-compliant documentation

📩 info@nnrvtradepartners.com

🌐 www.nnrvtradepartners.com

Your ICPO will look like it came from a global trading house.

Mini FAQ (5 Key Questions)

Do sellers accept ICPO without POF?

No.Can brokers send ICPO?

No — only buyers.Should ICPO include price?

Optional.Do buyers need a corporate website?

Yes.Can NNRV prepare the full ICPO + POF pack?

Yes — turnkey.

Why Choose NNRV Trade Partners?

Institutional petroleum expertise

Mastery of SWIFT-based trade finance

High-level compliance structuring

Professional ICPO preparation

Zero-fraud documentation

Global buyer and seller representation