Introduction – The Hidden Structure of EN590 Pricing (and Why 95% of Buyers Misunderstand It)

Most buyers entering EN590 or Jet A1 transactions don’t understand markup, gross vs. net pricing, or the internal commission structure behind a petroleum deal.

Result?

They ask the wrong questions

They reject legitimate offers

They expose themselves as inexperienced

Sellers refuse to engage

Broker chains collapse

Deals fail before KYC

The biggest mistake buyers make is expecting to see:

❌ Gross price

❌ Net price

❌ Detailed commission breakdown

❌ “Who gets what”

No real seller, refinery, allocation holder, or major trading house will ever disclose internal commission details.

This article explains:

The institutional definition of markup

Why gross vs. net should NEVER be shown to the buyer

How commissions are embedded invisibly into the transaction

Why transparency at the wrong stage destroys deals

How to structure an EN590 deal so that everyone gets paid without exposing the chain

How NNRV manages institutional pricing and protects all parties

This is the 2025 definitive guide.

SECTION 1 — Understanding the Real Context (Macro + Industry)

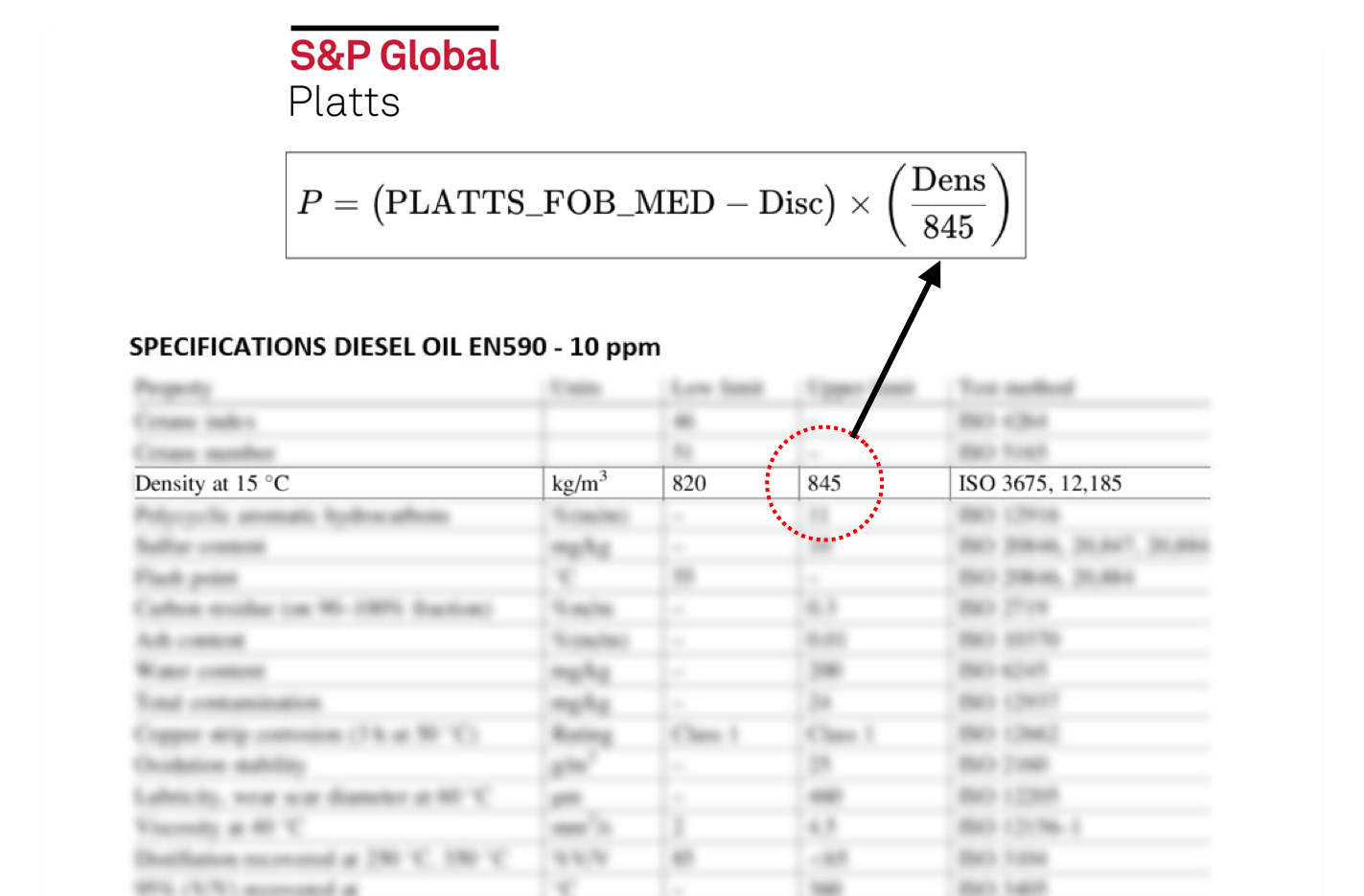

1.1 The Global Petroleum Market Is Built on Structured Pricing

In EN590 and Jet A1 trading, pricing is built on:

Platts index (daily benchmark)

Premiums & discounts

Logistics costs

Tank fees & terminal costs

Risk premiums

Commissions

Market availability

The final “gross price” sent to the end buyer already includes:

Seller margin

Mandate commissions

Facilitator commissions

Allocator fees

Terminal premiums

Risk premiums

Logistics premiums

The buyer only sees the final number, not the components.

1.2 Why Gross & Net Must Stay Confidential

Revealing the breakdown:

Creates conflict

Leads to commission disputes

Exposes internal strategy

Allows competitors to undercut

Causes intermediaries to circumvent each other

Violates refinery and terminal confidentiality rules

Creates AML/KYC red flags

Gross/net visibility destroys trust and invalidates the institutional structure.

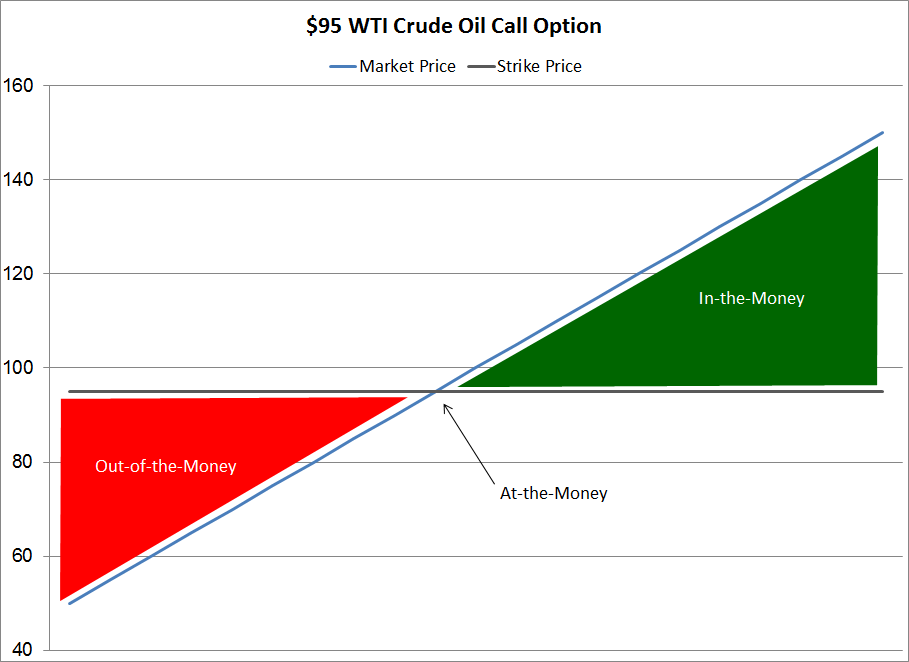

1.3 The Economics Behind Markup

Every EN590 price is structured as:

📌 **Platts (index)

Premium (logistics/market risk)

Markup (all commissions)

= Gross Price (what buyer pays)**

The buyer pays gross.

The seller receives net.

Everything in between is internal distribution.

SECTION 2 — Markup Explained From A to Z

2.1 What Is Markup?

Markup = the internal profit structure of the deal.

It includes:

Seller margin

Allocator/spv margin

Buyer-side commission

Seller-side commission

Facilitator fees

Introducer fees

In EN590, markup commonly ranges:

$10–$60/MT for TTT Rotterdam

$25–$80/MT for CIF

$5–$25/MT for pipeline/rail within the EU

Any markup outside this realistic range indicates:

❌ Fake offer

❌ Broker chain confusion

❌ Fraud

❌ Unbankable structure

2.2 Why Buyers Must NEVER See Markup

Because:

1. Markup is internal private information

It belongs to the seller and intermediaries.

2. Buyer has no legal right to know

Buyer receives a gross price, period.

3. Commissions inside markup must be protected

Intermediaries get paid through:

IMFPA

Fee protection agreements

Internal settlement

4. Refineries forbid revealing commission structures

POP, TSR, Q&Q, allocation letters — NONE reveal commission.

5. Banking compliance doesn’t allow buyers to influence internal distribution

Banks pay net → seller; seller distributes commissions via IMFPA.

SECTION 3 — NNRV Analysis: Why Markup Creates So Much Confusion

3.1 Top 5 Mistakes Buyers Make

Asking for gross/net breakdown

Refusing seller-side commissions

Comparing offers without understanding premiums

Treating EN590 like buying rice or cocoa

Thinking a lower markup = better deal

In petroleum trading, cheaper usually means fake.

3.2 Top 5 Mistakes Brokers Make

Promising the buyer “their price”

Adding their fees on top after SCO is issued

Not knowing how to hide their commission professionally

Not using IMFPA to protect themselves

Circulating SCOs with wrong markup

3.3 Institutional Risks Without Controlled Markup

| Risk | Description | Impact |

|---|---|---|

| Commission disputes | Brokers fighting internally | SPA collapse |

| Price manipulation | Brokers adding random fees | Buyer walks away |

| Non-compliance | Bank sees inconsistent numbers | Deal stopped |

| POP manipulation | Fake POP sold with wrong price | Compliance failure |

| SPA renegotiation | Buyer loses trust | Deal fails |

NNRV prevents all these problems through internal structuring.

SECTION 4 — Step-by-Step: How Real Markup Is Structured (Institutional Method)

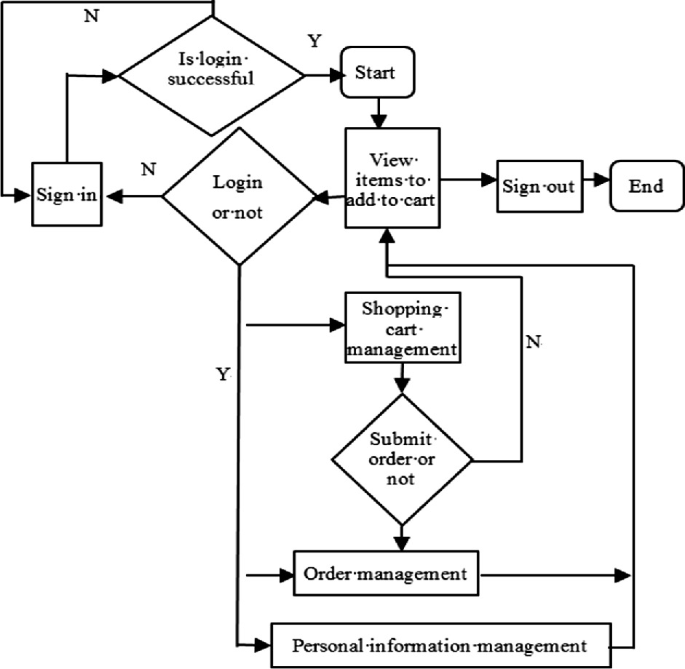

Step 1 — Buyer Submits ICPO

Includes procedure acceptance.

Step 2 — Seller Issues SCO

Price already includes markup.

Step 3 — NCNDA + IMFPA Signed

Intermediaries are protected.

Step 4 — SPA Issued

Only gross price is visible.

Step 5 — POP Released

No pricing structure revealed.

Step 6 — DIP Test / Q&Q

Operation validated.

Step 7 — MT103

Payment is made on gross price.

Step 8 — Seller Bank Disburses Funds

Seller receives net

Commissions distributed internally

Everything remains invisible to the buyer, as required by law and compliance.

SECTION 5 — Buyer & Seller Questions (20 Total)

10 Buyer Questions

Why don’t sellers show gross and net?

Does markup change daily?

Is markup negotiable?

Why do some brokers hide markup completely?

How do I know if markup is reasonable?

Can markup be too high?

Can the buyer remove commissions? (No.)

Does the buyer ever pay commissions separately?

Why is my price different from another buyer?

Can I know how much each broker earns? (Never.)

10 Seller Questions

How do I control markup with many intermediaries?

Should I show markup to mandates?

When should I finalize the commission distribution?

What markup is realistic for TTT Rotterdam?

What markup kills a deal? (Above $80/MT)

Who pays commissions? (Usually seller side.)

How do I prevent double-paying brokers?

Can IMFPA handle markup? (Yes.)

Should markup be visible in SPA? (No.)

How do I avoid fake buyers? (NNRV compliance filter.)

SECTION 6 — Proof & Credibility

This markup and pricing structure follows the standards of:

Vitol

Trafigura

Gunvor

Mercuria

Glencore

Shell Trading

TotalEnergies Trading

And is operationally aligned with terminals:

Vopak (Rotterdam / Fujairah)

Oiltanking (Houston / Amsterdam)

VTTI (Singapore)

Koole Terminals

These institutions NEVER reveal gross/net details to a buyer.

SECTION 7 — Professional Call to Action (CTA)

📌 Need Help Structuring Markup or Hiding Commissions Professionally?

NNRV Trade Partners provides:

Institutional markup structuring

Clean commission allocation

IMFPA creation and verification

Neutral coordination between intermediaries

Price integrity management

Full compliance review

📩 Send your ICPO, KYC, or SCO to:

compliance@nnrvtradepartners.com

🌐 Visit: www.nnrvtradepartners.com

Mini FAQ (5 Questions)

Can the buyer see commission structure?

No. It violates compliance and destroys the deal.Should I protect markup with IMFPA?

Always.What if brokers fight over markup?

NNRV restructures the chain professionally.Can markup be paid in crypto?

In institutional deals, no.Does markup apply to Jet A1 also?

Yes. Identical structure.

Why Choose NNRV Trade Partners?

Institutional approach

Compliance-driven structure

Expertise in EN590 / Jet A1 / SBLC / LC

Commission protection (IMFPA, NCNDA, escrow)

Price integrity & market alignment

Direct refinery/allocation access

Deal execution from A to Z

Global presence in EU/US/Asia/Africa