Performance Bond / Performance Guarantee (PBG) – Secure Your Contractual Obligations

🔹 What is a Performance Bond / Performance Guarantee (PBG)?

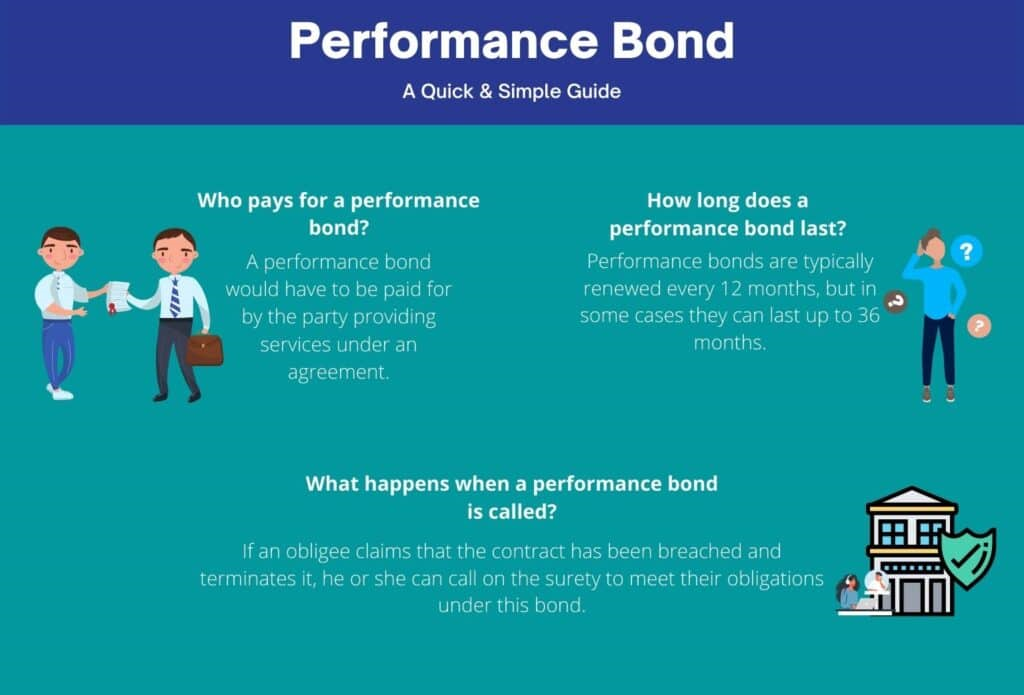

A Performance Bond (also called a Performance Guarantee or PBG) is a financial instrument issued by a reputable bank or financial institution to guarantee that a contractor or supplier will complete a project in accordance with the terms of the contract. If the contractor defaults or fails to meet their contractual obligations, the project owner (beneficiary) receives financial compensation up to the bond amount. Widely used across construction, infrastructure, procurement, energy, and government projects, a PBG ensures project completion, enhances trust, and minimizes financial risk.

Performance Bonds (URDG 758) — On-Demand Security for Projects & Procurement

We structure and place Performance Bonds / PBGs with top-tier and specialty banks, aligned to URDG 758 and your contract. This page covers how PBGs work, 15 application examples, a network of 40+ issuing/confirming banks with SWIFT codes, 10 reviews, and 15 FAQs.

How Does a Performance Bond Work?

- Request: The project owner requires a PBG as part of the contract.

- Issuance: The contractor obtains the bond from a bank/financial institution.

- Execution: The contractor performs the works per contract.

- Default: If obligations aren’t met, the owner files a complying demand.

- Compensation: The bank pays the owner in line with the bond terms.

Key Features

- Guarantees contractual fulfillment

- Protects project owners; boosts contractor credibility

- Typical amount: 10%–100% of contract value

- Valid through project + defects/warranty period

- Complies with ICC URDG 758 (on-demand)

Who Needs a PBG?

- Construction & Infrastructure companies (EPC, PPP)

- Procurement & supply chain operators

- Government contractors & bidders

- Engineering & manufacturing firms

- IT & technology service providers

- Oil & Gas / Energy EPC contractors

Required Documents

- Project contract / tender award

- Company trade license & articles of association

- Board resolution authorizing the guarantee

- Audited financials (2 years) + bank statements (6–12 months)

- Bond application form; bid/tender docs (if applicable)

15 Application Examples (Where Performance Bonds De-Risk Execution)

1) Highways & Bridges (EPC/PPP)

On-demand bond secures delivery milestones; step-down after section handover.

2) Power Plants & Substations

Covers grid-code compliance and COD; aligned with liquidated damages clauses.

3) Solar & Wind Farms

Protects performance KPIs (PR/availability); warranty tail included.

4) Oil & Gas (Onshore/Offshore)

Secures drilling, pipeline, or FPSO deliverables; multi-currency possible.

5) Water / Desalination / Wastewater

Covers capacity, quality specs, and commissioning deadlines.

6) Rail / Metro / Rolling Stock

Phased reductions on prototype acceptance and fleet deliveries.

7) Airports & Seaports

Bonds tied to critical path (runways, terminals, cranes).

8) Hospitals & Education Campuses

Public procurement alignment; independent engineer certification.

9) Data Centers & Telecom Towers

Uptime/latency SLAs built into draw conditions.

10) Mining & Mineral Processing

Covers plant throughput & recovery rates; environmental covenants.

11) Large Warehousing & Logistics Parks

Phased PBG across shells, MEP, automation fit-out.

12) Manufacturing Lines (OEM/Turnkey)

Factory acceptance → site acceptance → performance test sequence.

13) IT / Software Transformation

Milestone-based PBG tied to deliverables, go-live, and stabilization.

14) Defense & Public Safety Equipment

Strict specs; escrow + PBG combo reduces dispute risk.

15) Real Estate (Design-Build)

Performance + defects-liability coverage until completion/hand-over.

Issuing & Confirming Banks (40+)

Illustrative network; final placement depends on corridor, ticket, and KYC. Click any SWIFT to copy.

| Bank | Country/Region | SWIFT | Instruments | Notes |

|---|---|---|---|---|

| HSBC | Hong Kong / Global | HSBCHKHHXXX | PBG, SBLC, LC | Fast SWIFT; strict compliance |

| BNP Paribas | France / EU | BNPAFRPP | PBG, SBLC, LC | EU–global corridors |

| Mashreq Bank | UAE / MENA | BOMLAEAD | PBG, SBLC, LC | MENA projects |

| Standard Chartered | UAE / Asia / Africa | SCBLAEAD | PBG, SBLC, LC | Emerging markets |

| Bank of China (HK) | Hong Kong / Asia | BKCHHKHHXXX | PBG, SBLC, LC | APAC trade |

| UOB | Singapore / APAC | UOVBSGSG | PBG, SBLC, LC | ASEAN focus |

| Crédit Agricole CIB | France / Global | AGRIFRPP | PBG, SBLC, LC | Structured trade |

| JPMorgan Chase | USA / Global | CHASUS33 | PBG, SBLC, LC | Large cross-border |

| Bank of New York Mellon | USA / Global | IRVTUS3N | PBG, SBLC, LC | Agency & custody |

| Citibank | USA / Global | CITIUS33 | PBG, SBLC, LC | Multinationals |

| Deutsche Bank | Germany / Global | DEUTDEFF | PBG, SBLC, LC | Industrial & infra |

| Commerzbank | Germany / EU | COBADEFF | PBG, SBLC, LC | EU SMEs |

| Barclays | UK / EU | BARCGB22 | PBG, SBLC, LC | UK corridors |

| NatWest | UK | NWBKGB2L | PBG, SBLC, LC | Corporate banking |

| Société Générale | France / Africa | SOGEFRPP | PBG, SBLC, LC | Africa networks |

| UniCredit | Italy / EU | UNCRITMM | PBG, SBLC, LC | CEE corridors |

| Intesa Sanpaolo | Italy / EU | BCITITMM | PBG, SBLC, LC | Industrial clusters |

| UBS | Switzerland / Global | UBSWCHZH80A | PBG, SBLC, LC | Tier-1 acceptance |

| ING | Netherlands / EU | INGBNL2A | PBG, SBLC, LC | Trade & commodity |

| Rabobank | Netherlands / EU | RABONL2U | PBG, SBLC, LC | Agri/food chains |

| Santander | Spain / Global | BSCHESMM | PBG, SBLC, LC | Iberia/LatAm |

| BBVA | Spain / Global | BBVAESMM | PBG, SBLC, LC | LatAm reach |

| Nordea | Nordics / EU | NDEAFIHH | PBG, SBLC, LC | Northern Europe |

| SEB | Sweden / Baltics | ESSESESS | PBG, SBLC, LC | Baltic trade |

| Swedbank | Sweden / Baltics | SWEDSESS | PBG, SBLC, LC | Nordic supply |

| KBC | Belgium / EU | KREDBEBB | PBG, SBLC, LC | Benelux SMEs |

| MUFG | Japan / Global | BOTKJPJT | PBG, SBLC, LC | Consortiums & PPP |

| SMBC | Japan / Global | SMBCJPJT | PBG, SBLC, LC | Equipment/infra |

| Mizuho | Japan / Global | MHCBJPJT | PBG, SBLC, LC | Capital call cover |

| ANZ | Australia / NZ | ANZBAU3M | PBG, SBLC, LC | Resources & ports |

| Commonwealth Bank | Australia | CTBAAU2S | PBG, SBLC, LC | Property/infra |

| Westpac | Australia | WPACAU2S | PBG, SBLC, LC | National coverage |

| Emirates NBD | UAE / MENA | EBILAEAD | PBG, SBLC, LC | GCC corridors |

| First Abu Dhabi (FAB) | UAE / Global | NBADAEAA | PBG, SBLC, LC | Oil & gas |

| Qatar National Bank (QNB) | Qatar / MENA | QNBAQAQA | PBG, SBLC, LC | Energy/logistics |

| Standard Bank | South Africa | SBZAZAJJ | PBG, SBLC, LC | African projects |

| Nedbank | South Africa | NEDSZAJJ | PBG, SBLC, LC | Mining/infra |

| Absa | South Africa | ABSAZAJJ | PBG, SBLC, LC | PPP & concessions |

| ICBC | China / Global | ICBKCNBJ | PBG, SBLC, LC | Industrial/energy |

| Bank of Communications | China | COMMCNSH | PBG, SBLC, LC | Manufacturing |

| Bank of America | USA / Global | BOFAUS3N | PBG, SBLC, LC | Corporate deals |

| Royal Bank of Canada | Canada | ROYCCAT2 | PBG, SBLC, LC | North America |

| TD Bank | Canada | TDOMCATTTOR | PBG, SBLC, LC | Cross-border |

| Bank of Montreal (BMO) | Canada | BOFMCAM2 | PBG, SBLC, LC | Commercial |

| CIBC | Canada | CIBCCATT | PBG, SBLC, LC | Corporate |

| Scotiabank | Canada / LatAm | NOSCCATT | PBG, SBLC, LC | Ibero-Americas |

| CaixaBank | Spain / EU | CAIXESBB | PBG, SBLC, LC | Exporters |

| Itaú Unibanco | Brazil / LatAm | ITAUBRSP | PBG, SBLC, LC | LatAm infra |

| Banco do Brasil | Brazil | BRASBRRJ | PBG, SBLC, LC | Public works |

| PG Asia Investment Bank Ltd | Malaysia | AINEMY22 | PBG, SBLC, LC | APAC agility |

| Dushanbe City Bank | Tajikistan | LCMDTJ22 | PBG, SBLC, LC | Flexible jurisdiction |

| Standard Commerce Bank Ltd | USA | STDMDMDMXXX | PBG, SBLC, LC | Private structuring |

| Asia Pacific Investment Bank | Malaysia | ASPMMYKL | PBG, SBLC, LC | Confirmations possible |

| Digital Commercial Bank | USA | — | PBG, SBLC | SWIFT pending |

| Credit Foncier IM UND Export GmbH | Germany | CFEGDE82 | PBG, SBLC, LC | EU-regulated niche |

| Sapelle Int’l Bank Liberia Ltd | Liberia | GNERLRLM | PBG, SBLC, LC | Frontier markets |

| Unibanque | United Kingdom | UNBQGB22 | PBG, SBLC, LC | SME-friendly |

| Al-Amanah Islamic Investment Bank | Philippines | AIIPPHM1XXX | PBG, Islamic SBLC | Sharia-compliant |

| Point Bank | United Kingdom | POITGB21 | PBG, SBLC | Agile issuance |

| Ace Investment Bank Limited | Malaysia | AIBMMYKL | PBG, SBLC, LC | Short-term deals |

| Tabarak Investment Capital Ltd | UAE | TIBIAEADXXX | PBG, SBLC | MENA projects |

| United Bank for Investment | Iraq | UNTVIQBAXXX | PBG, SBLC | Regional trade |

| Golden Touch Investment Bank | Malta | GTIVMT2LXXX | PBG, SBLC | Private mandates |

We also coordinate with accredited brokers (e.g., Barcelona Capital Inc. among several partners) where corridor fit exists.

Secure Intake — Owners / Contractors

Client Reviews (10)

Frequently Asked Questions (15)

1) What rule set governs performance bonds?

2) Typical bond amount?

3) How do owners claim?

4) Can bonds step-down?

5) Currency options?

6) Issuance timeline?

7) Is a counter-guarantee needed?

8) What’s the difference vs. bank guarantee or SBLC?

9) Can I replace a corporate guarantee with a PBG later?

10) Are insurers involved?

11) Are PBGs transferable?

12) What if the owner is state-owned?

13) Can SMEs access PBGs?

14) What are typical costs?

15) Do you support amendments?

Compliance & Standards

All mandates undergo KYC/AML & sanctions screening. Instruments align to URDG 758 (on-demand guarantees) or ISP98 (standby letters). We may decline engagements that present elevated compliance or reputational risk.

🚀 Why Choose NNRV Trade Partners?

- ✔ Expertise in Trade Finance & Global Infrastructure

- ✔ Access to Top-Tier Issuing Banks

- ✔ Fast Turnaround & Compliance Assurance

- ✔ End-to-End Advisory & Documentation Support

- ✔ Risk Mitigation Solutions for All Projects

📎 Apply Now

Secure your project and boost your business credibility with a trusted Performance Bond from NNRV Trade Partners. 📧 Contact us to request a free consultation and receive the bond application form.Performance Bonds (URDG 758) – Building Trust and Securing Projects

Empowering global trade, infrastructure, and procurement through on-demand guarantees.

What is a Performance Bond?

A Performance Bond, also known as a Performance Bank Guarantee (PBG), is an irrevocable on-demand security issued by a bank on behalf of a contractor or supplier. It assures the project owner (beneficiary) that obligations under the contract will be met. If the contractor fails to deliver, the project owner can file a compliant demand and receive financial compensation directly from the issuing bank.

Governed by the ICC Uniform Rules for Demand Guarantees (URDG 758), Performance Bonds have become a universal tool for reducing project risk and increasing confidence in cross-border deals.

Why URDG 758 Matters

- Provides standardized global rules accepted in 100+ jurisdictions.

- Removes ambiguity in bond terms and claims procedures.

- Ensures fast processing of compliant demands (typically 5 business days).

- Reduces costly disputes between contractors and beneficiaries.

How Does a Performance Bond Work?

- Contract Requirement: The project owner requires a PBG as part of the agreement.

- Application: The contractor applies for the bond from a bank or financial institution.

- Issuance: The bank issues the guarantee in favor of the project owner.

- Execution: The contractor performs the works and delivers on commitments.

- Claim: If obligations are not met, the project owner files a demand.

- Payout: The bank compensates the beneficiary up to the guaranteed amount.

Strategic Benefits

- Protects project owners against non-performance and delays.

- Boosts contractor credibility in international tenders.

- Typical coverage: 10–30% of contract value.

- Valid through the project duration and often the warranty period.

- Accepted across industries: infrastructure, energy, IT, defense, and more.

Who Needs a Performance Bond?

Performance Bonds are widely used in sectors where contractual obligations are high-value and complex:

- Construction & Infrastructure (EPC, PPP projects)

- Procurement & Supply Chain Operators

- Government Contractors & Public Bids

- Engineering & Manufacturing Companies

- IT & Digital Transformation Projects

- Energy, Oil & Gas, and Renewable Developers

Practical Examples

- Highways & Bridges: Securing milestones in EPC and PPP concessions.

- Power Plants: Ensuring grid-code compliance and COD deadlines.

- Solar & Wind Farms: Guaranteeing performance ratios and availability KPIs.

- IT System Deployment: Protecting against delays in go-live and stabilization.

- Defense Contracts: Covering strict technical specifications and delivery timelines.

Documents Required

- Signed project contract or award notice

- Company incorporation documents & licenses

- Board resolution authorizing issuance

- Audited financial statements (2 years)

- Recent bank statements (6–12 months)

- Application form & tender documents (if applicable)

Strategic Role of Performance Bonds in Global Trade & Infrastructure

Beyond compliance: leveraging Performance Bonds as a catalyst for competitive advantage.

Performance Bonds as Strategic Financial Instruments

While many companies treat Performance Bonds (PBGs) merely as contractual obligations, leading global players use them as strategic instruments. In complex international transactions, PBGs unlock opportunities by:

- Enabling market entry: Contractors gain eligibility in high-value tenders where PBGs are mandatory.

- Enhancing trust: Owners prefer bidders backed by reputable banks, improving selection chances.

- Supporting liquidity: Structured bonds allow companies to protect working capital while maintaining credibility.

- De-risking projects: Governments and investors commit more easily to projects secured by on-demand guarantees.

Key Strategic Benefits

Performance Bonds are not only protective but also value-generating. Some benefits include:

- Competitive Edge in Bidding: Companies with strong banking partners issuing bonds are more likely to win contracts.

- Risk Allocation: Clearly defines responsibility and transfers default risk to financial institutions.

- Investor Confidence: Bonds provide assurance for project finance lenders, improving funding conditions.

- International Scalability: Compliance with URDG 758 makes bonds universally acceptable, easing cross-border growth.

- Reputation Building: Regular issuance and successful bond execution strengthen credibility in global markets.

Integration into Trade & Project Finance

In Structured Trade Finance (STF) and Project Finance, Performance Bonds serve as the glue that binds investors, contractors, and governments. Strategic uses include:

- PPP & Concessions: Ensuring delivery of public infrastructure without exposing taxpayers to excessive risk.

- Energy & Renewables: Mitigating risks in multi-phase projects (solar, wind, hydro).

- Cross-Border Supply Chains: Guaranteeing delivery in fragile jurisdictions.

- EPC & Turnkey Projects: Aligning execution milestones with financing disbursements.

- Strategic Alliances: Using bonds as negotiation leverage in joint ventures and consortiums.

How Governments and Multinationals Use PBGs

Performance Bonds are embedded in national infrastructure strategies and multinational procurement frameworks. Their strategic roles include:

- Governments: De-risk procurement in defense, utilities, and public-private partnerships (PPP).

- Multinationals: Standardize project risk management across jurisdictions.

- Export Credit Agencies (ECAs): Often require bonds before approving financing.

- Development Banks: Condition funding on the presence of compliant guarantees.

Strategic Trends in Performance Bonds

The use of Performance Bonds is evolving with global trade and finance. Strategic trends we observe include:

- Digitalization: Banks and corporates moving toward e-guarantees and blockchain-based issuance.

- Hybrid Structures: Combining PBGs with insurance, escrow, or standby LCs for layered protection.

- Green Finance: Bonds aligned with sustainability KPIs in renewable energy and ESG projects.

- Emerging Market Growth: Greater reliance on PBGs in Africa, Asia, and MENA to attract foreign investment.

- Portfolio Management: Firms strategically allocate bond limits across projects to maximize capital efficiency.

Strategic Questions for Decision Makers

Companies considering Performance Bonds as part of their growth strategy should ask:

- How does my choice of issuing bank impact my credibility in target markets?

- Can I structure bonds to minimize collateral and preserve liquidity?

- What hybrid structures (insurance + PBG + SBLC) could optimize risk mitigation?

- How do bonds align with my overall Structured Trade Finance strategy?

- Can I use bonds to expand into high-barrier markets where they are mandatory?

Risk & Compliance in Performance Bonds

Ensuring security, legal compliance, and risk mitigation in global projects.

Why Compliance Matters

Performance Bonds are only effective if they comply with international standards. The Uniform Rules for Demand Guarantees (URDG 758) issued by the ICC provide the global legal framework that ensures:

- Clarity: Standardized obligations for issuers, beneficiaries, and applicants.

- Enforceability: Guarantees are recognized across jurisdictions.

- Transparency: Clear timelines for claim presentation and examination.

- Legal Certainty: Reduced disputes and arbitration risks.

Risk Dimensions of Performance Bonds

Like any financial instrument, Performance Bonds carry specific risks. Understanding them is key to managing exposures:

- Beneficiary Risk: Unfair or abusive calls on the bond.

- Issuer Risk: Solvency of the issuing bank or guarantor.

- Jurisdictional Risk: Local legal interpretations may vary in enforcement.

- Liquidity Risk: Excessive collateral requirements impacting working capital.

- Operational Risk: Errors in documentation or delayed responses to claims.

Compliance with URDG 758

URDG 758 offers a globally accepted framework for demand guarantees. Compliance ensures that:

- Claims are honored on first demand if conditions are met.

- Disputes are minimized thanks to standardized terms and definitions.

- Parties have predictability in international enforcement.

- Banks and financial institutions operate within recognized global norms.

With URDG 758 compliance, Performance Bonds move beyond local contracts, becoming truly international risk-mitigation tools.

Risk Mitigation Strategies

To safeguard projects and preserve liquidity, leading firms adopt structured risk management approaches:

- Choosing Strong Issuers: Select banks or guarantors with international credibility and ratings.

- Negotiating Bond Wording: Ensuring terms comply with URDG 758 and prevent unfair calls.

- Hybrid Instruments: Using Standby Letters of Credit (SBLC) or insurance to diversify risk.

- Collateral Optimization: Minimizing cash collateral through structured treasury solutions.

- Jurisdictional Planning: Aligning bonds with favorable arbitration laws (e.g., English law, ICC arbitration).

Common Compliance Pitfalls

Many companies underestimate the complexity of Performance Bonds. Frequent issues include:

- Non-URDG compliant wording leading to legal disputes.

- Ambiguous claim procedures delaying enforcement.

- Underestimating local regulatory requirements.

- Inadequate due diligence on the issuing institution.

- Over-collateralization, reducing financial flexibility.

Proactive compliance management prevents costly project disruptions.

The Role of NNRV Trade Partners

At NNRV Trade Partners, we guide corporates, banks, and governments in ensuring full compliance with URDG 758 while structuring bonds that balance security and liquidity. Our services include:

- Drafting and reviewing guarantee texts for compliance.

- Negotiating with banks to reduce collateral requirements.

- Mitigating risks of abusive calls through strategic clauses.

- Ensuring enforceability across multiple jurisdictions.

- Integrating PBGs into comprehensive risk management frameworks.

Case Studies & Practical Applications of Performance Bonds

Real-world examples, banking partners, and global applications of Performance Bonds under URDG 758.

Case Study 1 – Construction & Infrastructure

A global construction company secured a $250M Performance Bond for a highway project in East Africa. By working with an AA-rated European bank, the contractor was able to guarantee performance to the government without immobilizing excessive cash. Compliance with URDG 758 ensured claims were transparent, reducing the risk of abuse.

Case Study 2 – Energy Sector

A renewable energy developer needed to provide a Performance Bond for a solar farm project in the Middle East. Partnering with Asian and Middle Eastern banks, the bond was structured to meet both international and local regulatory standards. The project launched successfully, backed by a guarantee enforceable across multiple jurisdictions.

Case Study 3 – International Trade & Procurement

A global trading house participating in a government procurement tender in Latin America issued a $50M Performance Bond. The issuing bank was supported by an international syndicate, including European and American banks. The bond gave credibility, allowing the trading house to secure the contract and deliver goods on time while minimizing liquidity risk.

Case Study 4 – Public-Private Partnerships (PPP)

In a PPP project for urban infrastructure, the consortium of private investors provided a Performance Bond through a major international bank. This reassured the government that obligations would be met, unlocking financing from multilateral development banks. Without the bond, the project financing would not have been approved.

Global Banking Partners in Performance Bonds

Performance Bonds require strong financial institutions with international recognition. Below are 35 global banks frequently involved in issuing or confirming Performance Bonds under URDG 758:

- HSBC – UK

- Barclays – UK

- Standard Chartered – UK

- BNP Paribas – France

- Société Générale – France

- Crédit Agricole – France

- Deutsche Bank – Germany

- Commerzbank – Germany

- UniCredit – Italy

- Intesa Sanpaolo – Italy

- Banco Santander – Spain

- CaixaBank – Spain

- UBS – Switzerland

- Credit Suisse – Switzerland

- Raiffeisen Bank International – Austria

- J.P. Morgan – USA

- Citibank – USA

- Bank of America – USA

- Wells Fargo – USA

- Goldman Sachs – USA

- Morgan Stanley – USA

- Mitsubishi UFJ Financial Group (MUFG) – Japan

- Sumitomo Mitsui Banking Corporation (SMBC) – Japan

- Mizuho Bank – Japan

- Bank of China – China

- ICBC – China

- China Construction Bank – China

- Bank of Communications – China

- DBS Bank – Singapore

- OCBC – Singapore

- UOB – Singapore

- Emirates NBD – UAE

- First Abu Dhabi Bank (FAB) – UAE

- Qatar National Bank (QNB) – Qatar

These institutions are recognized globally for their ability to issue, confirm, or guarantee Performance Bonds, giving international contractors, suppliers, and investors the security they need in large-scale projects.