Introduction — Choosing the Wrong Product Can Destroy a New Buyer

Every new entrant in petroleum trading asks:

“Should I start with Jet A1?”

“Is EN590 easier?”

“Is Crude Oil where the real money is?”

But most fail because they choose products they cannot finance, deliver, or manage operationally, resulting in:

❌ Rejection by sellers

❌ Failure during compliance

❌ Inability to pass POP/Q&Q

❌ Tank farm issues

❌ Vessel mismanagement

❌ Loss of credibility

❌ Wasted time with fake deals

This article gives you the real, institutional-level comparison of Jet A1, EN590, and Crude Oil—and reveals which product is BEST for new buyers in 2025.

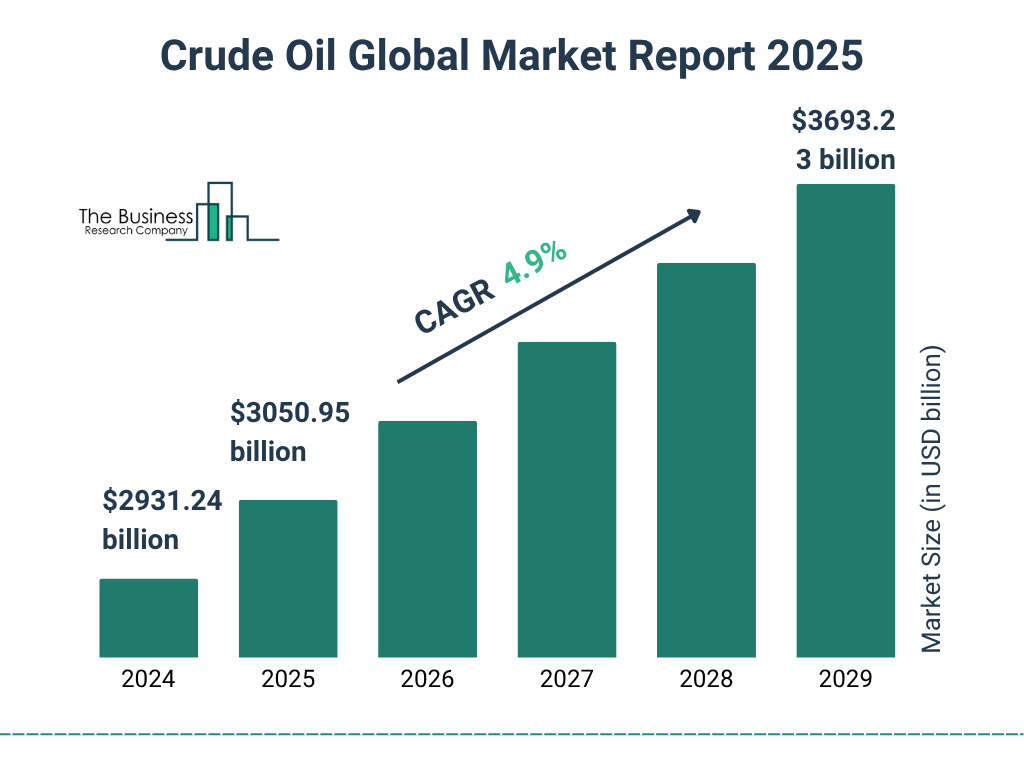

SECTION 1 — Understanding the Real Market Context

1.1 Refineries Do Not Sell Everything to Everyone

Different products have different:

Buyers

Compliance requirements

Logistics

Specifications

Risks

You cannot approach Jet A1 the same way you approach EN590 or Crude.

1.2 Price Is NOT the Issue — Operations Are

New buyers often choose a product because:

“It’s high demand”

“Profit margin is big”

“Everyone wants Jet A1”

But they ignore:

Tank farm logistics

Q&Q requirements

Vessel scheduling

POP verification

Refinery allocation

Financial capability

Exposure to fraud

The best product is the one you can actually deliver.

1.3 Fraud Risk Differs by Product

Fraud distribution by product (based on global institutional data):

Jet A1: 78% fraud rate

Crude Oil: 62% fraud rate

EN590: 45% fraud rate

Fake sellers TARGET Jet A1 because buyers know little about aviation standards and fall for “cheap Jet A1 deals” that do not exist.

SECTION 2 — Technical Comparison (A–Z): Jet A1 vs EN590 vs Crude Oil

2.1 Basic Definitions

| Product | Category | Main Users | Storage | Risk Level | Buyer Difficulty |

|---|---|---|---|---|---|

| Jet A1 | Aviation Turbine Fuel | Airlines, Militaries | Strict | Very High | Very Hard |

| EN590 | Ultra-Low Sulfur Diesel | Heavy transport, industry | Moderate | Medium | Medium |

| Crude Oil | Unrefined Petroleum | Refineries | High | High | Hard |

2.2 Jet A1 (Aviation Fuel) — Highly Regulated

Pros

High global demand

Strong institutional buyers (airlines, governments)

Premium pricing

Cons

Requires strict aviation specifications (ASTM D1655, DEF STAN 91-091)

High fraud rate

Storage must be aviation-grade

POP/Q&Q extremely strict

No tolerance for contamination

Difficult for new buyers to enter

Sellers only accept top-tier buyers

Verdict:

Not recommended for new buyers in 2025.

Requires too much compliance, capital, and operational precision.

2.3 EN590 (Diesel 10 ppm) — Best for Beginners

Pros

Most traded refined product in the world

Easier to store, move, and sell

Tank farms widely accessible

SGS/Q&Q process straightforward

Lower fraud rate vs Jet A1

Flexible logistics (TTT, FOB, CIF)

Smaller parcel sizes available (1,000–50,000 MT)

Many real sellers

Cons

Requires understanding of tank farm operations

Still prone to scams if buyer is inexperienced

TTT/TTT must be handled properly

Operational documents must match refinery batch

Verdict:

Best product for new buyers in 2025.

Easiest to understand, execute, validate, and deliver.

2.4 Crude Oil — High Reward, High Risk

Pros

Very high volume

Very high potential profit (if structured)

Refineries buy constantly

Long-term contracts possible

Cons

Requires massive financing (LC, SBLC, AR, inventory financing)

Vessel chartering is mandatory

POP verification extremely complex

Government involvement in many markets

Documentary risk very high

Fake “Crude allocations” everywhere

Minimum orders often 500,000–2,000,000 barrels

Verdict:

Not recommended for beginners.

Only suitable once buyer has mastered EN590 logistics.

SECTION 3 — NNRV Expert Analysis: Which Product Should New Buyers Choose?

3.1 EN590 Is the ONLY Logical Starting Point

Reasons:

Lower compliance barrier

Real supply available

Refineries and tank farms are easier to verify

Document chain is simpler

Parcels sizes are accessible

Jargon is easier to master

Fraud risk manageable with guidance

POP/Q&Q easier to validate

Jet A1 and Crude are “graduate-level products”.

EN590 is the correct entry point.

3.2 Why Jet A1 Is a Trap for Beginners

New buyers fail because they do not understand:

Freeze point testing

Aromatics limits

Conductivity requirements

Aviation storage standards

Additive packages

Pipeline restrictions

Airport delivery requirements

Fake sellers exploit this lack of knowledge.

3.3 Why Crude Requires Institutional Capability

Crude trading requires:

LC/MT760 issuance

Vessel chartering

Cargo insurance

NOR/SOF management

Lifting rights validation

Government approvals

Seismic data verification

Beginners cannot handle these tasks safely.

SECTION 4 — Step-by-Step Guide: How a New Buyer Should Start in 2025

**Step 1 — Begin with EN590 (3,000–10,000 MT)

The correct entry point.**

Step 2 — Learn tank storage, Q&Q, injection, pipeline logistics

Step 3 — Verify real sellers (via NNRV)

Step 4 — Structure your buyer profile properly

KYC + CP + POF + history.

Step 5 — Execute 1–3 small deals

Step 6 — Move to larger volumes (25k–50k MT)

Step 7 — Only then consider Jet A1 or Crude

This is the real path used by institutional trading desks.

SECTION 5 — 20 Buyer & Seller Questions (Institutional Answers)

10 Buyer Questions

Which product is easiest to buy? → EN590

Why not Jet A1 first? → Too complex + high fraud

What is the minimum EN590 parcel? → 1,000–10,000 MT

Is Crude impossible? → Not impossible, but requires capital

Why EN590 TTT is common? → Safe + quick + verifiable

Is Jet A1 ever discounted? → Never

Who verifies seller? → NNRV

Should I store or resell? → Depends on your capital

Do I need tanks to start? → Not always

Can I switch to crude fast? → Only after proven delivery ability

10 Seller Questions

Should I sell Jet A1 to new buyers? → No

Why do beginners fail? → Lack of logistics understanding

What is safest buyer structure? → Corporate + distributor

How do I avoid fake buyers? → KYC + NNRV validation

Should I accept CIF first? → Risky

Does EN590 require POP early? → No

Can I offer multiple products? → Yes, after proven delivery

How do I build trust? → Through consistent small deliveries

Should I release POP? → Only after SPA

Can NNRV coordinate logistics? → Yes

SECTION 6 — Why Refineries, Terminals, and Traders Agree With This Hierarchy

Global institutions align on this sequence because of:

ASTM/EN standards

Refinery allocation rules

ISPS port compliance

Basel III documentation

ICC Incoterms 2020

Major trading house risk scoring systems

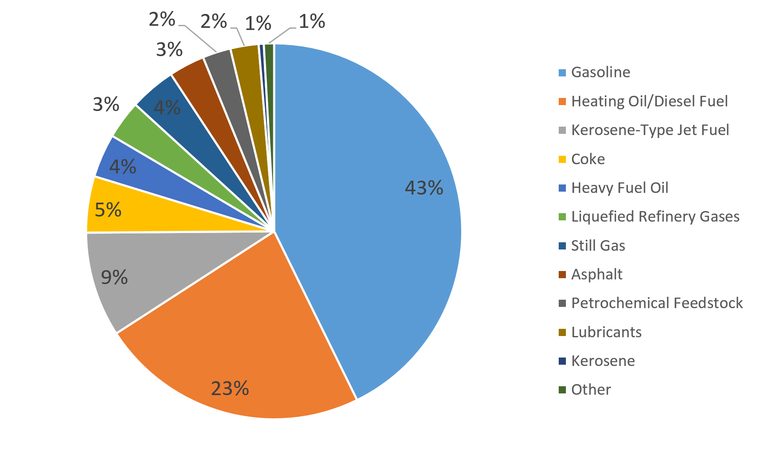

Every major trading house trains new traders in the same order:

Diesel (EN590)

Gasoline

Jet A1

Crude

Because operational complexity increases at each level.

SECTION 7 — Professional CTA

📌 Want to Start Safely as a Petroleum Buyer in 2025?

NNRV Trade Partners offers:

Buyer profile structuring

Real seller verification

Risk & compliance validation

Tank farm & Q&Q assistance

Step-by-step buyer onboarding

Institutional EN590 deal facilitation

📩 info@nnrvtradepartners.com

🌐 www.nnrvtradepartners.com

Start safely. Grow strategically. Win consistently.

Mini FAQ (5 Key Questions)

Do airlines buy directly from brokers?

No—only from certified suppliers.Is EN590 always available?

Yes—refineries produce it continuously.Can a beginner buy Crude?

Not without institutional capital.What product has the lowest fraud?

EN590 (when verified by NNRV).What’s the recommended first deal?

1,000–10,000 MT EN590 TTT Rotterdam/Houston/Fujairah.

Why Choose NNRV Trade Partners?

Institutional onboarding for new buyers

Anti-fraud & compliance expertise

Verified allocation access

Real tank farm and refinery verification

Full operational assistance

Global EN590 expertise