Introduction — Why 98% of Buyers Are Rejected Before SPA or POP

In EN590, Jet A1, LPG, Crude, and all SBLC/LC-backed trade finance transactions, the #1 reason deals collapse is NOT price, NOT procedure, NOT POP…

👉 It is because the buyer’s profile is not acceptable.

Most buyers fail before the seller even reads the ICPO because:

KYC is incomplete

Documents are inconsistent

Company profile is unclear

Bank readiness is questionable

Buyer looks like a broker chain

No proof of activity or financial standing

Poor email domain & unprofessional communication

A clean, institutional buyer profile determines whether:

✔ the seller responds

✔ the seller issues SCO

✔ the seller accepts SPA

✔ the seller releases POP

✔ the terminal grants DTA

✔ the refinery proceeds

This article teaches you exactly:

What a “clean buyer profile” is

Why sellers reject 98% of buyers

How to structure a compliant KYC pack

What documents must match

What institutional sellers expect

How NNRV builds institutional profiles for clients

This is the 2025 industry guide every buyer needs.

SECTION 1 — Understanding the Context: Why KYC Matters in Petroleum

1.1 Sellers Are Under Extreme Compliance Pressure

Refineries, tank farms, and international sellers must comply with:

FATF AML

Basel III

OFAC / EU Sanctions

Terminal access rules

Bank risk scoring

Corporate compliance frameworks

SWIFT bank-to-bank communication rules

This means sellers need to verify:

✔ Buyer’s legality

✔ Buyer’s financial standing

✔ Buyer’s capacity to perform

✔ Buyer’s history

✔ Buyer’s KYC structure

✔ Buyer’s bank profile

If anything looks suspicious, the seller rejects automatically.

1.2 Fake Buyers, Broker Chains, and Scams Created New Barriers

In 2025, sellers are more cautious than ever because of:

Fake LOIs/ICPOs made with Google Docs

Buyers with no company

People trying to use personal bank accounts

Buyers pretending to have POF

Broker chains presenting themselves as “direct buyers”

Buyers who don’t know TTT/FOB logic

Buyers asking for fake procedures (DTA before SPA, POP before KYC, etc.)

This is why sellers screen buyers at KYC stage.

1.3 The Seller Wants One Thing: Institutional Credibility

A real seller wants the buyer to look like:

A real corporate actor

A professional operator

A financially capable entity

A compliance-ready organization

Someone who understands petroleum structure

A good buyer profile instantly answers:

👉 “Are you a real buyer?”

👉 “Can you perform?”

👉 “Are you worth my time?”

SECTION 2 — Complete A–Z Breakdown: What Makes a Clean Buyer Profile

Let’s break down the exact structure of a clean, institutional buyer profile.

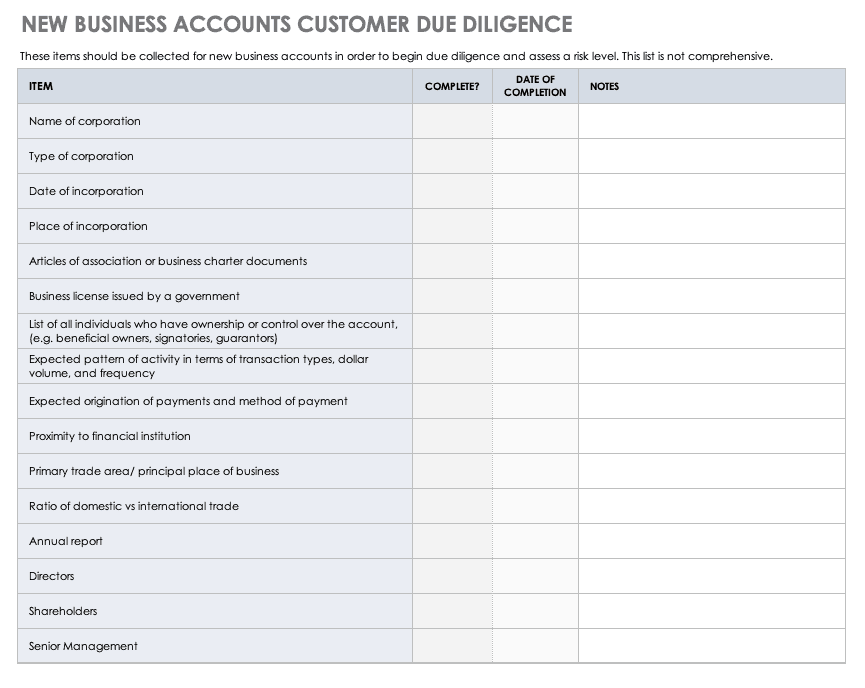

2.1 Corporate Documents (The Foundation)

A real buyer must provide:

Certificate of Incorporation

Company Extract / Registry Document

Shareholder Structure

Passport(s) of UBO(s)

TIN / VAT Registration

Corporate Resolution (if required)

Important:

All documents must match the company name on ICPO and KYC.

2.2 Corporate Profile (Most Buyers Fail Here)

Your corporate profile must show:

Company introduction

Activities & history

Fuel consumption or distribution capacity

Locations & subsidiaries

Key contracts (no confidential details)

Corporate website

Business email (NO Gmail/Outlook/Yahoo)

Leadership team

Market focus

A profile that looks like a “one-man broker operation” is rejected instantly.

2.3 Financial Standing: The Hardest Part

Sellers need to see:

Bank name

Country of account

Ability to issue MT799 / MT103 / LC / SBLC

Transaction capacity

Buyers should NOT send:

Screenshots

Bank statements

PDF extracts

Fake POF

Instead, they should send:

Soft Proof of Funds (RWA / BCL)

Letter of Comfort

Bank coordinates (for future MT799)

2.4 Contact Structure: Professional and Institutional

Buyers MUST provide:

Company domain email

Signature block showing position

Phone number (not WhatsApp only)

Corporate LinkedIn page

Full address

A buyer using:

“Director of Everything”

No registered office

…is immediately rejected.

2.5 Transaction Readiness

A clean buyer profile must show:

Target product (EN590/Jet A1/LPG)

Target quantity

Target procedure (FOB/TTT/etc.)

Target port (Rotterdam, Fujairah, Houston)

Payment method (MT103/SBLC/LC)

Tank availability (for TTT)

Vessel availability (for FOB/TTV)

SECTION 3 — NNRV Expert Analysis: Why Sellers Reject Bad Profiles

3.1 Incomplete KYC = 100% rejection

Missing:

Passport

Incorporation

Phone

Website

Company extract

→ Seller rejects in 30 seconds.

3.2 No proof of financial capacity

If buyer cannot show capacity to issue:

MT799

RWA

SBLC

LC MT700

Seller will NOT release SCO or POP.

3.3 Buyer acts like a broker, not a real buyer

Characteristics of fake buyers:

No company

No tank

No vessel

No POF

Wants “DTA first”

Doesn’t know procedures

Doesn’t control end buyer

NNRV filters these out immediately.

3.4 Red Flags Sellers Use to Reject Buyers

A seller will reject instantly if:

Buyer’s email is a generic email

Buyer uses WhatsApp-only communication

Buyer asks for POP before SPA

Buyer refuses to share company documents

Buyer mixes procedures (FOB+CIF+TTT in one ICPO)

Buyer cannot answer simple questions about logistics

Buyer submits inconsistent documents

3.5 The 8 Elements of a Perfect Buyer Profile (NNRV Standard)

Clean KYC package

Corporate profile (2–6 pages)

Compliance-ready documents

Professional communication

Clear financial capability

Understanding of petroleum procedures

Ability to perform (tank/vessel/LC/SBLC)

Realistic price expectations

SECTION 4 — Step-by-Step: How to Build a Clean Buyer Profile (Day 1–7)

📅 Day 1 — Gather Corporate Documents

Incorporation

Registry extract

Passports

Tax certificate

📅 Day 2 — Create Professional Company Profiles

2-6 pages

PDFs only

Clear branding

📅 Day 3 — Establish Corporate Communication

Email domain (@company.com)

Signature block

Website active

📅 Day 4 — Bank Readiness Preparation

Request RWA or BCL

Prepare bank officer contact

Gather bank coordinates

📅 Day 5 — Define Precise Transaction Scope

Quantity

Incoterm (FOB / TTT / TTV / CIF)

Destination port

Payment method

📅 Day 6 — Prepare Buyer KYC Pack

Company documents

Corporate profile

Passport

Bank info

LOI/ICPO

📅 Day 7 — Submit KYC → Pre-Approval

A seller who sees this will respond instantly.

SECTION 5 — Buyer & Seller Questions (20 Total)

10 Buyer Questions

Why do sellers reject without explanation?

Why does email domain matter?

What is the minimum POF needed?

Why must ICPO match KYC?

Why do sellers ask for website?

Why is bank officer contact needed?

Can I use personal bank account? (No)

Why must I show readiness before SPA?

Why do sellers refuse to deal on WhatsApp?

Can NNRV build my buyer profile? (Yes)

10 Seller Questions

Should I ignore buyers with no website? (Yes)

Should I reject generic emails? (Yes)

Should I accept incomplete KYC? (No)

Should I issue SCO to weak buyers? (No)

What if buyer hides UBO identity?

Should I accept buyer’s own procedure?

Should I release POP without POF? (Never)

What if buyer refuses compliance?

Should I deal with brokers pretending to be buyers?

How can NNRV filter buyers?

SECTION 6 — Proof & Institutional Credibility

These standards reflect the compliance rules of:

SGS, Intertek, Saybolt

Shell Trading

Vitol, Trafigura, Gunvor, Glencore

Vopak, Oiltanking, Koole

European Chamber of Commerce KYC rules

FATF AML & Basel III

SWIFT KYC & BIC compliance

This is global petroleum protocol.

SECTION 7 — Professional Call to Action (CTA)

✅ Need a Clean Buyer Profile That Sellers Respect?

NNRV Trade Partners offers:

Full KYC preparation

Corporate profile creation

Bank readiness structuring (RWA/BCL/POF)

Compliance pack for sellers

ICPO preparation

Buyer legitimacy enhancement

SWIFT workflow preparation

📩 info@nnrvtradepartners.com

🌐 www.nnrvtradepartners.com

Mini FAQ (5 Questions)

Can NNRV create my buyer profile?

Yes — complete corporate structuring.Can I submit KYC without bank readiness?

No — high risk of rejection.Do I need a website?

Yes — essential for legitimacy.Should all documents match?

Absolutely — consistency = trust.Can NNRV verify seller acceptance probability?

Yes — 100% institutional screening.

Why Choose NNRV Trade Partners?

Institutional compliance expertise

Knowledge of seller expectations

100% professional buyer representation

Complete anti-fraud filtration

Access to refinery-aligned sellers

Global transaction supervision

Confidential & secure processing