Introduction — The Truth About Commission: Why Buyers Never See It and Sellers Never Put It on the Invoice

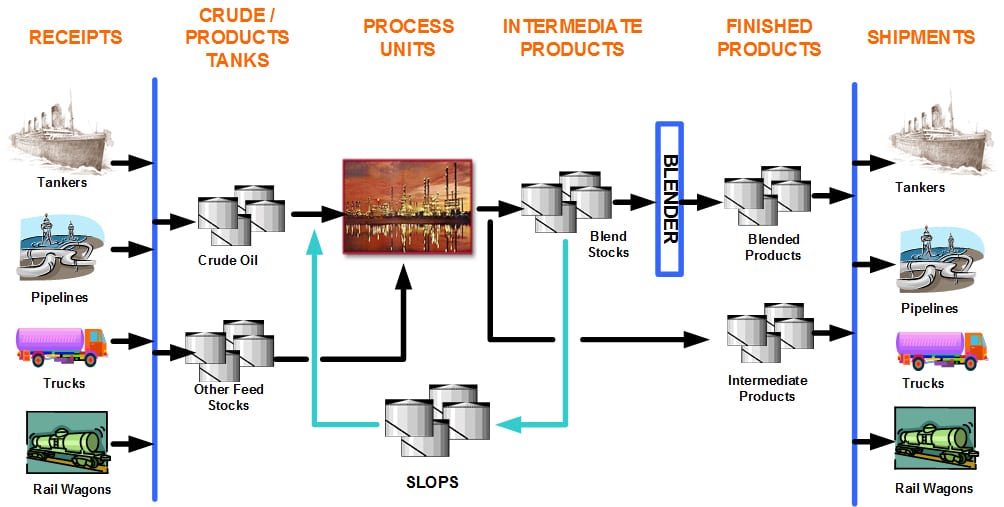

In petroleum trading—EN590, Jet A1, Diesel, LPG, Crude, Fuel Oil—commission is one of the most misunderstood aspects of the business.

New buyers often ask:

“Where is commission written?”

“Why is markup hidden?”

“Why is commission never on the invoice?”

“Why does the buyer pay gross?”

“How do intermediaries get paid?”

The reality is simple:

👉 Commission is NEVER shown on the invoice because it is a confidential, internal, bank-protected payment made AFTER MT103, through structured IMFPA splits.

If commission appeared on the commercial invoice:

Buyers would bypass intermediaries

Chains would collapse

Sellers would be exposed

Contracts would be challenged

Compliance issues would arise

This article explains how commission is REALLY paid, why it is invisible, how IMFPA protects intermediaries, and how to set up a legal, secure commission structure for all parties involved.

SECTION 1 — Understanding the Context: Why Commission Cannot Appear on the Invoice

1.1 The Commercial Invoice Is a Legal Document Between Buyer and Seller Only

A Commercial Invoice is governed by:

ICC Incoterms

International trade law

VAT / customs regulation

Marine shipping standards

Banking compliance (MT103 / LC / SBLC)

It cannot list:

Intermediaries

Brokers

Mandates

Facilitators

Consultants

Introducers

Side agreements

These parties are not the legal buyer or seller.

Therefore, commission cannot appear in the invoice.

1.2 Commission Appearing on the Invoice Would Break Several Laws

If commission appeared on invoice:

❌ VAT irregularities

❌ Banking compliance breach

❌ Customs misreporting

❌ Anti-bribery/sanction risks

❌ Auditing inconsistencies

❌ Contractual invalidation

Thus:

👉 Commission must remain outside the invoice to remain legal and compliant.

1.3 The Buyer Pays ONLY the Gross Price

In petroleum trading, the buyer pays:

Gross price (all-inclusive)

Through MT103 or LC

After DIP test / Q&Q (depending on procedure)

What happens inside that gross price is completely internal.

SECTION 2 — The Real Mechanism: How Commission Is Paid Legally and Invisibly

Below is the actual financial architecture used globally by refineries, traders, and mandates.

2.1 Two Prices Exist in Every Deal: Gross & Net

1. Net Price (Refinery/Seller price)

This is the real price the seller receives.

It remains confidential.

2. Gross Price (Buyer price)

This is the price the buyer pays.

It includes:

Seller-side commission

Buyer-side commission

Mandate fees

Facilitator spreads

Trader markup

Allocator commission

The buyer pays ONE price.

The internal distribution happens after payment.

2.2 Commission Is Paid from the Spread Between Gross and Net

Example:

Net price: $580/MT

Gross price: $595/MT

Spread: $15/MT

Distribution:

Seller side → $7

Buyer side → $5

Mandates/introducers → $3

This spread is structured in the IMFPA.

2.3 The IMFPA (International Master Fee Protection Agreement) Controls Everything

The IMFPA:

Lists ALL beneficiaries

Specifies exact commission amounts

Locks payment seats

Prevents bypass

Activates automatically at MT103

Is protected by bank compliance

It is not between buyer and seller.

It is between:

Mandates

Consultants

Facilitators

Intermediaries

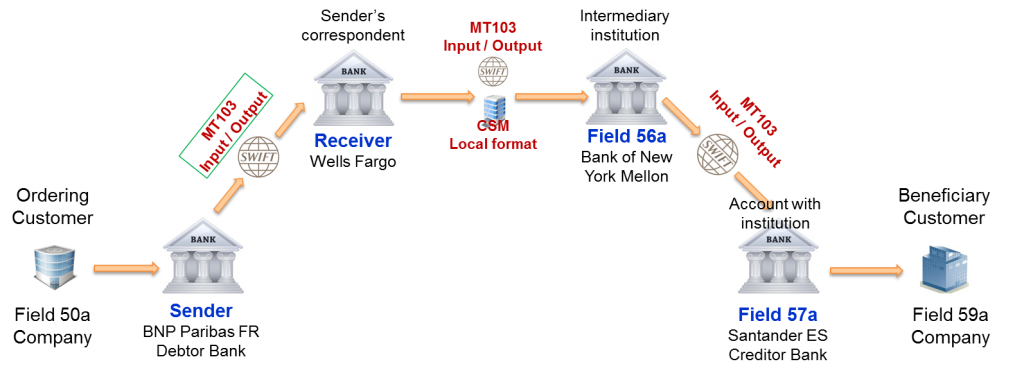

2.4 Commission Is Paid AFTER MT103 Using Split Payments

Once MT103 hits the seller’s bank:

Bank receives gross amount

Bank deducts net amount to seller

Bank releases commission (according to IMFPA)

Funds are sent automatically to all beneficiaries

This ensures:

✔ No upfront commission

✔ No fraud

✔ Automatic protection

✔ Zero buyer involvement

2.5 Why Commission MUST Be Invisible to the Buyer

If buyers saw:

Net

Commission

Broker chain

Markup

They would:

Bypass intermediaries

Negotiate net

Break the deal

Demand seller-side visibility

Challenge SPA

Violate confidentiality

Institutional buyers know better—

they never ask for commission structure.

SECTION 3 — NNRV Expert Analysis: How to Protect Commission and Avoid Losing the Deal

3.1 Avoid the #1 Red Flag: Asking About Commission

Buyers who ask:

“How much commission is built in?”

“Who gets paid what?”

“Can you show me net price?”

Are immediately flagged as:

❌ Brokers

❌ Non-institutional

❌ High-risk

❌ Non-serious

3.2 Ensure Every Intermediary Signs IMFPA Before SPA

To protect all commission beneficiaries:

✔ All parties sign IMFPA

✔ Payment seats are locked

✔ Bank coordinates payout

✔ No party can change the chain

✔ No party can be removed

This is the global standard.

3.3 Keep Commission Outside the Main SPA

SPA = Buyer ↔ Seller

IMFPA = Intermediaries

Mixing the two is illegal and non-compliant.

3.4 Never Add Commission on Top of Gross Price

Gross price = final.

Commission is included INSIDE the gross price.

3.5 Maintain a Clean, Short Chain

The shorter the chain:

The higher the payout per metric ton

The faster the deal

The fewer compliance issues

SECTION 4 — Step-by-Step: How Commission Is Paid (Institutional Sequence)

Step 1 — SPA Is Signed (Gross Price Confirmed)

Everything else is internal.

Step 2 — IMFPA Is Finalized and Accepted

All commission seats locked.

Step 3 — Buyer Issues MT103

Payment hits seller’s bank.

Step 4 — Bank Splits Funds Internally

Seller → receives net

Intermediaries → receive commission

Mandates → receive fees

Step 5 — Product Is Released

Injection / loading / discharge.

SECTION 5 — Buyer & Seller Questions (20 Q&A)

10 Buyer Questions

Why don’t I see commission on the invoice?

Who pays commission?

How is markup determined?

Does commission affect my price?

Can I know the net price? (No)

Can I change the chain?

Does seller see my side commission? (No)

When is my price final?

Can IMFPA be modified later?

Can NNRV structure my commission legally?

10 Seller Questions

How do I protect my mandate?

How is commission split legally?

Should intermediaries be disclosed to buyer? (Never)

When should IMFPA be signed?

How do I avoid bypass?

Can commission be paid in crypto? (No, institutional banks only)

How do I handle a long chain?

What if buyer demands net?

Can commission be added later?

Can NNRV administer the entire commission system?

SECTION 6 — Why This Method Is Globally Accepted

This model complies fully with:

ICC Incoterms 2020

Basel III banking rules

FATF AML/CFT standards

OFAC / EU / UN sanctions

International SWIFT protocol

SGS / Intertek industry norms

Used universally by:

Vitol

Trafigura

Gunvor

Glencore

Shell Trading

TotalEnergies

Mercuria

This is the only legitimate way commissions are paid.

SECTION 7 — Professional Call to Action

📌 Need to Structure Commission Legally and Securely?

NNRV Trade Partners provides:

IMFPA drafting

Commission protection strategy

SWIFT-compliant payout structure

Chain organization & mandate verification

Full compliance oversight

Seller/buyer-side settlement advisory

📩 info@nnrvtradepartners.com

🌐 www.nnrvtradepartners.com

We make sure every party is protected, every payment is compliant, and every commission is secured.

Mini FAQ (5 Key Questions)

Is commission ever visible to the buyer?

No.Who pays commission?

The buyer pays gross; bank distributes.When is commission paid?

After MT103.Can intermediaries protect their fee?

Yes—IMFPA is the legal protection.Can NNRV manage commission distribution?

Yes—full institutional structuring.

Why Choose NNRV Trade Partners?

Institutional petroleum expertise

Professional compliance structuring

Legal commission protection

SWIFT-level advisory

Zero-fraud documentation

Global transaction experience