Introduction — SBLC Is the Key to Unlocking Real EN590 Purchasing Power

Many buyers want to purchase EN590 (diesel) but lack:

Full cash upfront

Trade credit lines

Strong banking relationships

Access to non-recourse financing

Ability to lift large volumes (10,000–50,000 MT)

SBLC (Standby Letter of Credit) is the most powerful institutional tool to finance petroleum purchases—but only when used correctly.

The problem?

90% of buyers do not understand:

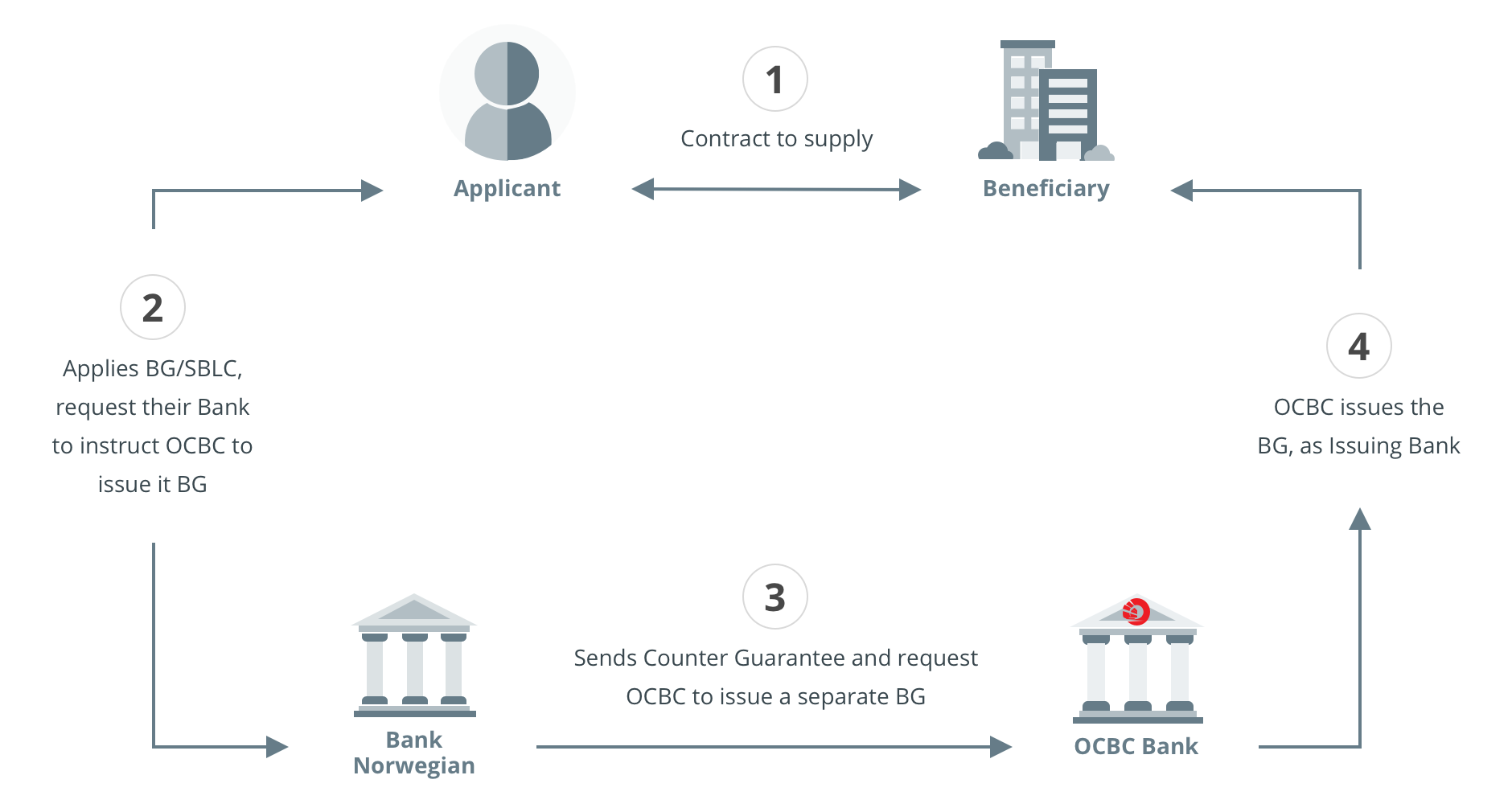

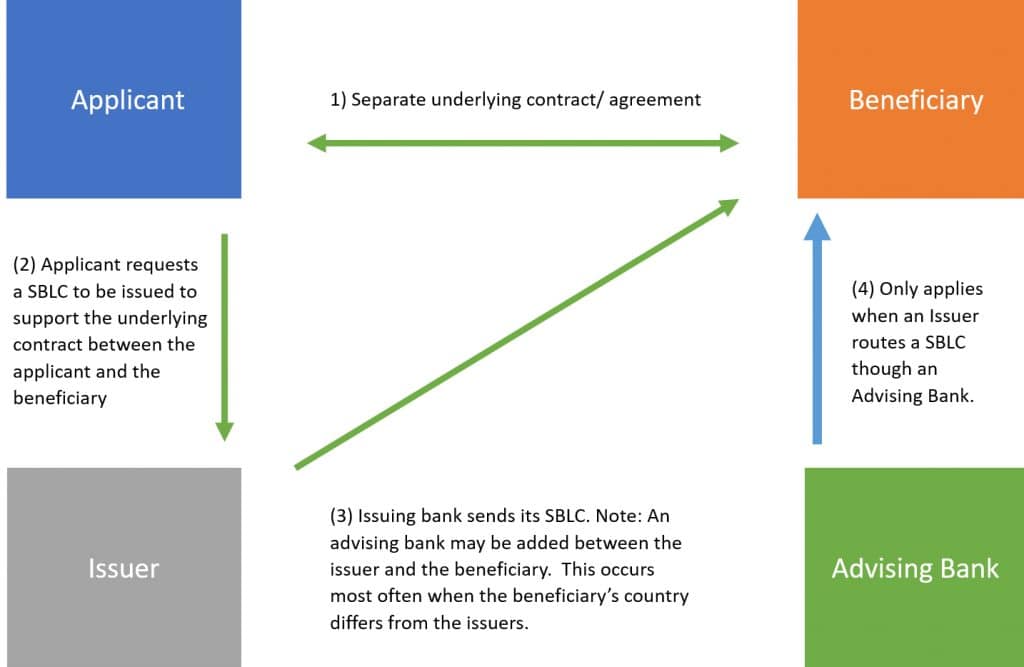

How an SBLC is issued

How it backs a petroleum transaction

How monetization works

How to structure a non-recourse loan

How LTV (Loan-to-Value) is determined

How SBLC-secured repayment works

This guide explains the exact step-by-step method a buyer can use to finance EN590 deals using SBLC—the same method used by professional trading houses and non-bank financial institutions.

SECTION 1 — Understanding SBLC: What It Is and What It Is NOT

1.1 SBLC (Standby Letter of Credit) = Bank Payment Guarantee

Issued under MT760 SWIFT, an SBLC:

Guarantees payment on behalf of buyer

Acts as collateral

Allows seller to proceed safely

Allows lenders to provide credit against it

An SBLC is not:

❌ Cash

❌ A loan

❌ Proof of funds

❌ BPU (Bank Payment Undertaking)

❌ Bank Comfort Letter

It is a contingent liability—a bank promise to pay if the buyer defaults.

1.2 Why Sellers Prefer SBLC Over Cash

Real EN590 sellers prefer SBLC for several reasons:

They reduce buyer risk

They secure payment

They allow large-volume lifts

They protect seller in case of default

They activate non-recourse financing

They enable LTV-based credit lines

In 2025, most refinery allocation sellers require SBLC MT760 for 25,000–100,000 MT monthly contracts.

1.3 Why SBLC Is Better Than MT799 or Proof of Funds

| Instrument | Strength | Weakness |

|---|---|---|

| SBLC MT760 | Payment guarantee | Requires KYC + bank compliance |

| MT799 | Bank-to-bank intent | Non-binding |

| RWA | Ready & willing | Not a guarantee |

| BCL | Shows capability | Not usable for financing |

| POF | Confirms cash | Does not leverage credit |

SECTION 2 — How SBLC Financing Works for EN590 (A–Z Overview)

There are three main models:

SBLC for Payment Guarantee (Standard)

SBLC for Credit Line / Trade Finance

SBLC Monetization (Non-Recourse Loan)

We explain each one.

2.1 Model 1 — SBLC as Payment Guarantee (Standard Trading)

Process:

Buyer issues SBLC MT760 to seller or escrow agent

Seller proceeds with Q&Q, injection, and loading

After delivery, buyer pays via MT103

SBLC serves as backup guarantee

Advantages:

✔ Safe for seller

✔ No cash required upfront

✔ Long-term monthly contract possible

2.2 Model 2 — SBLC to Open a Credit Line

Banks or non-bank lenders provide trade finance:

60–80% LTV credit line

Based on SBLC value

Used to buy EN590 at scale

Example:

A buyer issues a $10M SBLC.

The lender gives $7M credit line.

The buyer uses it to purchase EN590 monthly.

2.3 Model 3 — SBLC Monetization (Non-Recourse Loan)

This model is used by major traders.

Process:

Buyer issues SBLC MT760 to monetizer

Monetizer gives 60–75% LTV cash loan

Loan is used to buy EN590

Profit from sale repays loan

This allows buyers with little cash to purchase fuel in bulk.

SECTION 3 — NNRV Expert Analysis: The Real Workflow to Finance EN590 with SBLC

This is the true institutional workflow, not the Telegram version.

3.1 Step 1 — Buyer Completes KYC + CP + CIS

NNRV validates:

Company identity

Financial standing

Experience level

Operational capability

3.2 Step 2 — Buyer Arranges SBLC Issuance With Their Bank

Requirements:

Audited financials

Collateral

Credit line

Banking relationship

Buyer instructs bank to prepare:

MT799 pre-advice

MT760 draft

Compliance package

3.3 Step 3 — Buyer Sends ICPO + Proof of SBLC Readiness

Seller reviews:

Buyer capability

Buyer credibility

Volume & terms

Contract structure

If approved → buyer receives SCO.

3.4 Step 4 — SPA Signed + SBLC Delivery Timeline Set

SPA will specify:

Day for MT799

Day for MT760

Non-performance penalties

Procedure (FOB, CIF, TTT)

Injection timelines

Q&Q obligations

3.5 Step 5 — Buyer Issues MT799 (Optional Pre-Advice)

MT799 signals:

Buyer is committed

Bank is ready

SBLC will follow

3.6 Step 6 — Buyer Issues SBLC MT760

SWIFT MT760 must contain:

Exact amount

Exact tenor

Full wording

ICC rules reference

Bank officer contact

Once received → seller provides:

2% PB (Performance Bond)

POP bundle

Q&Q + tank allocation

3.7 Step 7 — Seller Executes Delivery

Based on buyer’s chosen structure:

TTT tank-to-tank injection

FOB loading (Rotterdam, Fujairah, Houston)

CIF delivery to buyer’s port

3.8 Step 8 — Buyer Pays With MT103 After Delivery

SBLC guarantees the seller in case buyer delays or defaults.

SECTION 4 — Step-by-Step Example: Financing 10,000 MT EN590

Scenario:

Buyer has $500,000 cash.

Wants to buy 10,000 MT EN590 (~$6M).

Solution:

Buyer issues $6M SBLC

Lender finances 70% = $4.2M

Buyer uses $500k + $4.2M to buy 10,000 MT

Buyer resells with margin

Profit repays lender

Buyer retains difference

SBLC released at contract end

This is how real traders scale without cash.

SECTION 5 — Buyer & Seller Questions (20 Institutional Answers)

10 Buyer Questions

Do I need full cash to buy EN590? → No, SBLC solves it.

Can I monetize my own SBLC? → Yes.

Is leased SBLC acceptable? → No for petroleum.

Can I buy EN590 with MT799? → No.

Does SBLC replace payment? → No, it guarantees it.

What LTV can I get? → 60–80%.

How long does SBLC take to issue? → 3–14 days.

Can a weak company issue SBLC? → No.

Who verifies seller before I risk my SBLC? → NNRV.

Can SBLC finance monthly contracts? → Yes.

10 Seller Questions

Should I accept SBLC? → Yes.

Should I accept leased SBLC? → Never.

Can SBLC be forged? → Yes—NNRV checks it.

When do I release POP? → After MT760.

When does PB issue? → After confirming SBLC.

Who pays SWIFT fees? → Each party pays its own.

Is SBLC safer than MT799? → Absolutely.

Can SBLC cover demurrage? → If structured.

Should I demand MT799 first? → Often yes.

Can NNRV structure SBLC wording? → Yes.

SECTION 6 — Why SBLC Financing Works Globally

SBLC is recognized under:

ICC UCP 600

ISP 98

Basel III collateral rules

SWIFT MT messaging protocol

International banking law

Refinery compliance standards

This makes it universally accepted by:

Refineries

Title holders

Allocation sellers

Banks

Tank farms

Trade finance houses

SECTION 7 — Professional CTA

📌 Need SBLC-Based EN590 Financing?

NNRV Trade Partners offers:

Buyer onboarding

SBLC wording & bank support

Monetization access

60–80% LTV credit solutions

Non-recourse trade finance

Full SPA/SWIFT coordination

📩 info@nnrvtradepartners.com

🌐 www.nnrvtradepartners.com

Unlock the power of SBLC.

Scale your EN590 business today.

Mini FAQ (5 Key Questions)

Can I buy EN590 with no cash?

Yes—with SBLC monetization.Is leased SBLC accepted by refineries?

No—only owned/issued SBLC.How long must SBLC be valid?

12 months + 1 day for yearly contracts.What if my bank refuses to issue SBLC?

NNRV guides alternative solutions.Can SBLC be used internationally?

Yes—globally recognized.

Why Choose NNRV Trade Partners?

Institutional trade finance expertise

Direct SBLC monetization channels

Strong banking networks

Real refinery allocation verification

End-to-end transactional support

Anti-fraud protection at every stage